Outcomes

If you are thinking about going to school or are already in college, you may be wondering what options you have to pay for school and how to know which school is offering you the best deal. In this module we will cover:

- Different types of aid

- How to apply for different types of aid (see Applying for Financial Aid for more information on the FAFSA and WASFA)

- Understanding award letters

- Comparing award letters

Once your have successfully jumped over the hurdles of applying to schools, filing out the FAFSA (or WASFA), and maybe even applying for other scholarships; now it’s time for the exciting part – deciding where to go to school!

As your acceptance letters and award letters come rolling in, take some time to compare your offers. A few key things to compare are:

- The estimated total cost of attendance à does it accurately reflect your living situation, travel expenses, etc.?

- How much of your total costs can be covered by grants and scholarships?

- Are there work-study opportunities available to you?

- How much will you have to pay using savings and loans?

Also, consider the school’s:

- Graduation rate;

- Loan default rate;

- Graduate earnings;

- And if the school is a good fit for you

This is just the tip of the iceberg! Take the plunge and join us in the rest of this module as we help you understand aid options and give you the tools you’ll need to start comparing your award letters!

What options do I have for paying for college?

When it comes to paying for college, you generally will be relying on a combination of the following:

| Payment Method | Options |

|---|---|

| Money that is given to you that you don’t have to pay back |

|

| Money that you work for |

|

| Savings (not an option for many students) |

|

| Money that is given to you that you have to pay back with interest (loans) |

|

How do I go about qualifying for different types of financial aid?

- Fill out the FAFSA (or WASFA if you are not eligible for federal aid). This will determine your eligibility for federal (or state) grants and loans, as well as work-study and some scholarships

- Talk to the financial aid office at your school to see what scholarships and other options are available at your institution

- For scholarships outside of your school, take a look at The WashBoard for scholarships for Washington students and see if there are any scholarships being offered by local organizations

- Fill out other applications for scholarships, graduate research or teaching assistantships, or tuition waivers

So now I have my award letter, what should I be looking for?

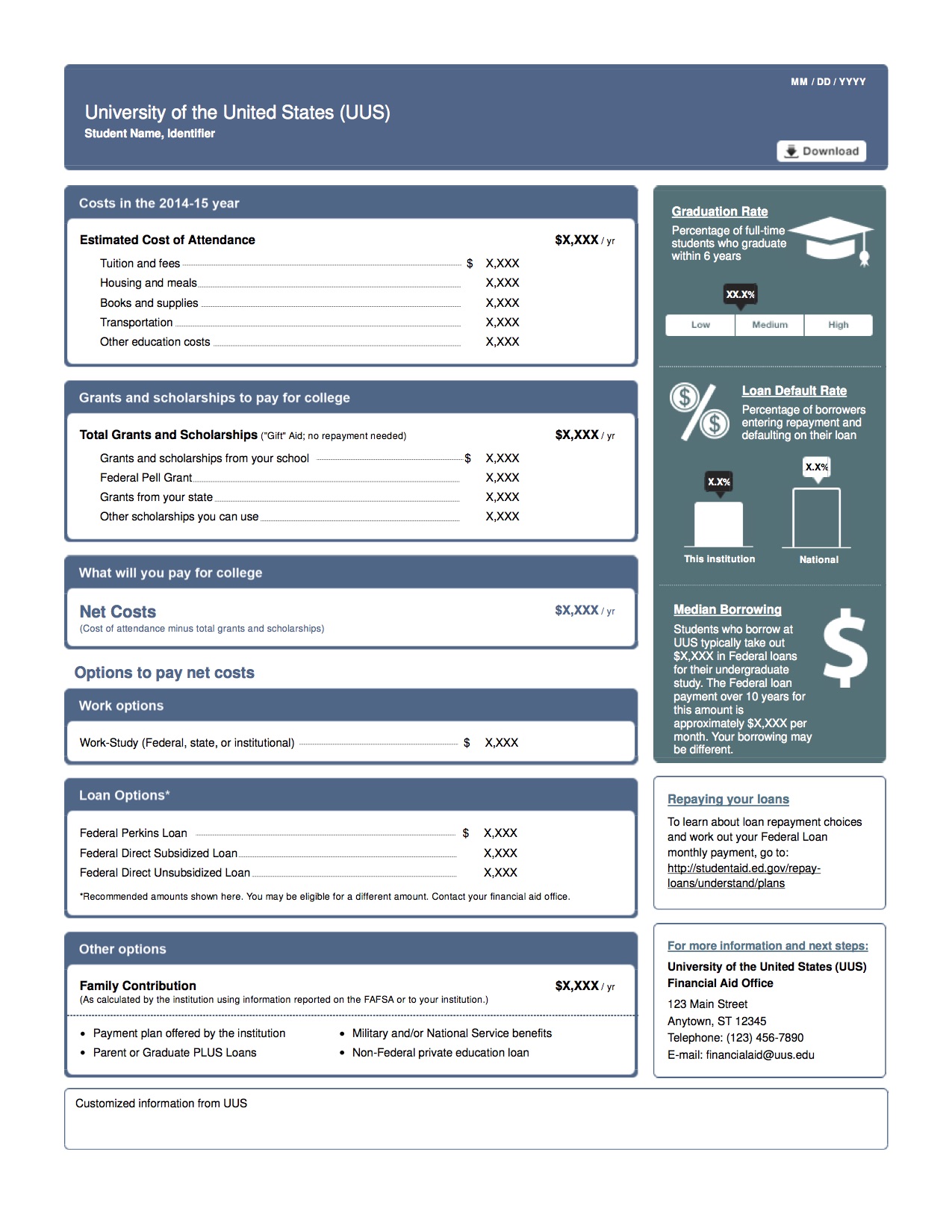

In 2021, all award letters in Washington will be standardized so it is easier to understand and compare your awards. In the meantime, take a look at this example provided by the U.S. Department of Education.

As you look through your award letter, consider the following:

- Is the estimated cost of attendance relevant to you (i.e. if you live at home, your housing costs may be lower and your commuting costs may be higher)?

- How much of your costs will be covered by gift aid (grants and scholarship) and what are the requirements for maintaining the gift aid (GPA minimum, Satisfactory Academic Progress (SAP)?

- What work-study opportunities are available to you?

- For graduate programs, are Graduate Assistantships or Graduate Teaching Assistantships available to you? These awards usually waive tuition and pay you a stipend in exchange for employment at the university.

- How much money will you and/or your family have to pay with savings?

- Will you have to take out a loan?

- If so, how much money will you have to borrow?

I am trying to decide between schools, how do I know which one gave me the better offer?

Comparing colleges can be hard, but the Advanced Award Letter Comparison Tool from finaid.org is a good place to start! This tool helps you to easily compare award offers and non-financial characteristics of the schools.

Here are some things you may want to compare when making your decision:

-

- Your award letters

- Graduation rates (the higher the better)

- Loan default rates (lower is better)

- Graduate earnings (higher is better) for the schools and programs you are considering

What other factors should I consider?

In addition to costs, you should consider a number of other factors in deciding which school to attend such as:

- Is the school a good fit for me?

- What percentage of students who enroll actually graduate

- Do graduates find jobs in their career of choice?

- How successful are graduates in their professional careers?

Check Your Understanding

#1. Which of the following are common options for financing college?

All of these are common ways to finance college

#2. When thinking about a school’s default rate, which is better?

A lower default rate suggests that graduates are doing better financially after graduation because they are able to keep up with their loan payments.

#3. What is the most important thing to consider when deciding which school to go to?

Some people may be looking to minimize financial costs, others may have to stay in a certain location to support family, and others may have other non-financial priorities

Results

Nicely done! It looks like you really understand this module!

If you are still a little confused, you may want to review this module.