Outcomes

While it may sound simple in theory, we know that paying back loans can be challenging and confusing. In this module we’ll help you gain a better understanding of:

Sometimes it can be hard to afford your monthly student loan payments, but if you have federal loans, you might be able to find relief by changing your repayment plan!

To change your repayment plan:

- Log into studentaid.gov

- Check your balance, monthly payments, servicer, and repayment plan

- Use Student Aid’s tool for finding the best repayment plan for your current situation

- Change your repayment plan if needed

In some situations of extreme financial hardship, you may be approved to go a few months without making any loan payments! To learn more about the pros and cons of different repayment plans, consider exploring the rest of this module!

How do I start repayment?

The first step to repayment is understanding the loan(s) you have, the servicer(s) you will be working with, and what repayment plan(s) you currently are on. For federal loans, all of this information can be found by logging into studentaid.gov and then contacting your servicer.

For private loans, you will want to contact your lender (and servicer, if that is a different organization) to learn more about your current repayment plan and any alternatives.

If you do not know who your lender is, you can check your credit report here.

What repayment plans are available?

For federal loans, you will automatically be enrolled in the Standard Repayment Plan. While this option has the highest monthly payments of all options, this means that you will pay the loan off faster and not have to pay as much interest. There are also Graduated, Extended, Income-Driven, and Income Sensitive plans.

Which option is right for you? Below we have included a bit of information on each plan, but we also recommend you check out the Department of Education’s Loan Simulator for more personalized recommendations.

| Payment Plan | Characteristics | Pros | Cons |

|---|---|---|---|

| Standard |

|

|

|

| Graduated |

|

|

|

| Extended |

|

|

|

| Income-Driven |

|

|

|

| Income Sensitive |

|

Similar benefits to Income Driven Plans |

|

| Repayment Plan | Characteristics | Pros | Cons |

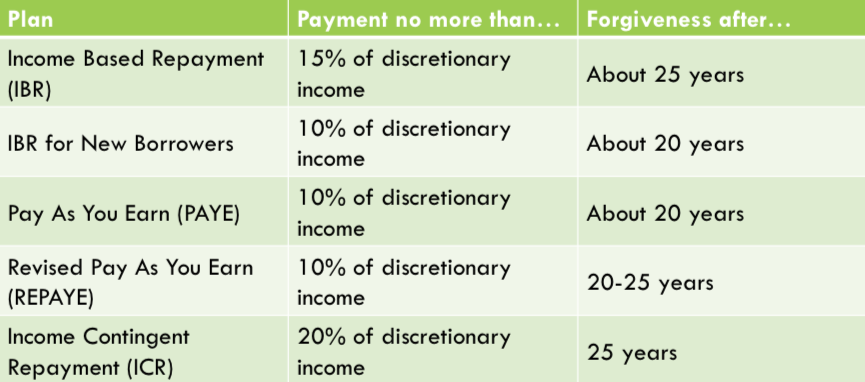

If you are interested in an Income-Driven Repayment (IDR) plan and have Direct Loans, you have a few options to choose from:

What can I do if I still can’t make my monthly payment?

As soon as you realize you are unable to make your monthly payment, contact your loan servicer! Whether you have federal or private loans, your servicer will be able to offer you personalized guidance on your options. If you miss a loan payment and do not have another arrangement in place, you may be marked delinquent and after nine months your loans could default.

If you are struggling to make your payments, you have a few options:

- An Income-Driven Repayment (IDR) plan

- Deferment

- Forbearance

Note: deferment and forbearance are short-term solutions for when you cannot pay or have higher than normal expenses (examples: car accident, moving, medical issues).

A reduced payment (as low as $0 per month) through an IDR plan is a longer-term solution if you have a limited income as you are moving closer to the end of your repayment period and interest is not capitalized.

If your servicer offers you a deferment, you will have a period of time where you do not have to make a monthly payment toward your principal or interest. For federal loans, the government may pay the interest during this period for you. In other cases, the interest accrued during deferment may be capitalized (added to your principal).

If you don’t qualify for deferment, you may be able to receive forbearance. In this case, you may be able to pay a lower rate or stop making payments for a year. During this period, you will still need to pay the interest accrued on your loan or it will likely be capitalized. In certain specific situations, your lender must grant you a forbearance.

Check Your Understanding

#1. Which of the following repayments are always available for private loans? (choose all that apply)

All of the loan repayment options shown here are repayment options for federal loans; talk to your private lender to see if they offer any alternative repayment plans.

#2. To change your federal repayment plan, you should contact your loan servicer.

You will automatically be in a Standard Plan, but your servicer can help you change to another repayment plan for which you may qualify.

#3. Which of the following is not true of Income-Driven plans?

To qualify for Public Service Loan Forgiveness, you need to be enrolled in an Income-Driven plan; however, they are not the same program. All other statements are true.

Results

Nicely done! It looks like you really understand this module!

If you are still a little confused, you may want to review this module.